Gifts That Cost You Nothing Now

Your legacy could be an end to gun violence

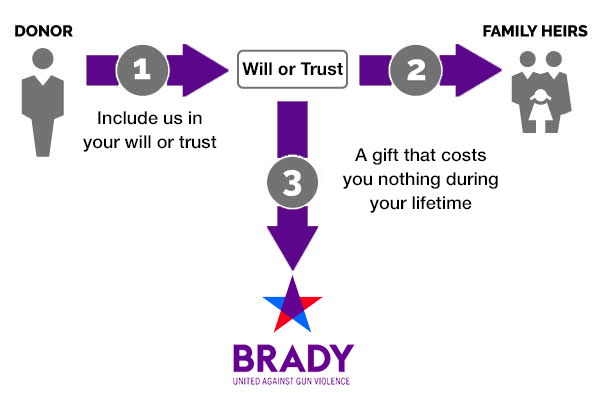

Gifts in a will or by beneficiary designation are two easy ways to create a safer America for future generations — and they don’t cost anything now.

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact for Brady’s efforts to prevent gun violence. By simply signing your name, you can establish a legacy of creating life-saving change for this deadly epidemic.

Once you have provided for your loved ones, we hope you will consider making comprehensive gun violence solutions part of your life story through a legacy gift.

We’ve partnered with FreeWill to make creating your legacy of gun violence prevention easier than ever. This simple and secure tool guides you through making your plan in as little as 20 minutes — 100% cost-free.

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

NO COST

Costs you nothing now to give in this way.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

LASTING IMPACT

Your gift will create your legacy of ensuring every community is safe and free from gun violence.

Four simple, “no-cost-now” ways to give in your will

General gift

Leaves a gift of a stated sum of money to Brady in your will or living trust.

Residual gift

Leaves what is left over after all other debts, taxes, and other expenses have been paid.

Specific gift

Leaves a specific dollar amount, percentage, fraction, or specific items (collections, art, books, jewelry, etc.).

Contingent gift

Leaves a stated amount or share only if a spouse, family member or other heir/beneficiary does not live longer than you. In other words, your gift is contingent upon whether or not they survive after you.

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to Brady contingent upon the survival of your spouse.

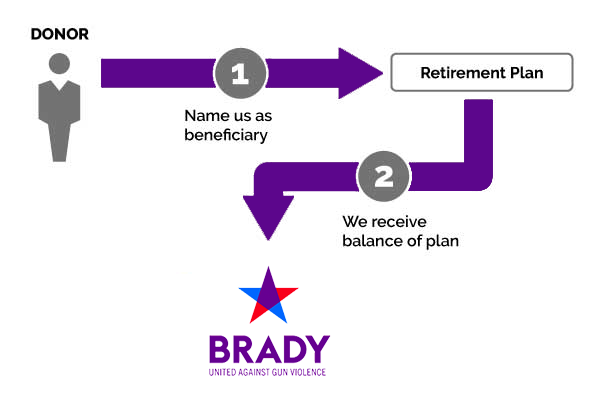

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, saving tons, and more to use in the fight to end gun violence.

By naming Brady as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of bringing positive change to people across America living in fear of gun violence.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now to give

Create your legacy with Brady

To name Brady as a beneficiary of an asset, contact the custodian of that asset to see whether a change of beneficiary form must be completed.

How to change a beneficiary designation:

Login to your account or request a Change of Beneficiary Form from your custodian (the business holding your money or assets).

Follow the links to change your beneficiary or fill out the form.

Be sure to spell the name of our organization properly: Brady Campaign to Prevent Gun Violence 501(c)(4) (non-tax-deductible) or Brady Center to Prevent Gun Violence 501(c)(3) (tax-deductible)

Include our tax identification number: Brady Campaign #23-7321017 or Brady Center #52-1285097

Save or submit your information online or return your Change of Beneficiary Form.

You can also use this free tool to organize your assets and learn how to add us as a beneficiary!

Types of Gifts

A gift of retirement funds

You can simply name the Brady Center or Campaign as a beneficiary of your retirement plan to create a safer America by reducing the public health epidemic of gun violence.

A gift of funds remaining in your bank or brokerage accounts

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name the Brady Campaign (Tax ID: 23-7321017) or the Brady Center (Tax ID: 52-1285097) as a beneficiary of your checking or savings bank account, a certificate of deposit (CD), or a brokerage account. When you do, you’ll take a powerful step toward ending gun violence in our country for future generations.

Donor-Advised Fund (DAF) residuals

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name Brady as a “successor” of your account or a portion of your account value, you enable our life-saving work in Congress, the courts, classrooms, and communities across the country.

Savings bonds

If you have bonds that have stopped earning interest and you plan to redeem them, you might owe income tax on the appreciation. That could result in your heirs receiving only a fraction of the value of the bonds in which you invested. Since the Brady Center is a tax-exempt institution, naming us as a beneficiary means that 100% of your gift will go toward advocacy, education, and litigation.